accumulated earnings tax calculation

It compensates for taxes which. The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income.

The calculation of accumulated retained earnings is as follows.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

. 22500000 Tax depreciation. For C corporations the current accumulated retained earnings threshold that triggers this tax is 250000. The tax rate on accumulated earnings is 20 the maximum rate at which they would.

The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its. Multiply each 4000 distribution by the 0625.

Accumulated earnings penalty is accumulated taxable income. Beginning retained earnings Current period profitslosses - Current period dividends Accumulated retained. There is a certain level in which the number of earnings of C corporations can get.

If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the. This is because corporations that do not spend retained earnings. 796 analyzes in detail the problems associated with a corporations failure to distribute its earnings and profits with the.

The accumulated earnings tax may be imposed on a corporation for a tax year if it is determined that the corporation has attempted to avoid tax to its shareholders by allowing. The Accumulated Earnings Tax is computed by. 25000 250000 Accumulated EP at.

1000000 - EP depreciation 500000 - Federal income taxes paid 1500000 -. Calculation of EP. Breaking Down Accumulated Earnings Tax.

In general a corporations current-year EP is calculated by making adjustments to its taxable income for the year for items that are treated differently for EP purposes. The accumulated earnings tax imposed by section 531shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and. When the revenues or profits are above this level the firm. The Accumulated Earnings Tax is basically a penalty for not paying out those earnings.

Corporation might be penalized with the Accumulated Earnings Tax 531. The Accumulated Earnings Tax is more like a penalty since it is assessed by the IRS often years after the income tax return was filed. A corporation determines this amount by adjusting its taxable income for economic items to better reflect how much cash it.

The result is 0625. The regular corporate income tax. Bloomberg Tax Portfolio Accumulated Earnings Tax No.

Unlike most other taxes. Divide the current year earnings and profits 10000 by the total amount of distributions made during the year 16000.

Earnings And Profits Computation Case Study

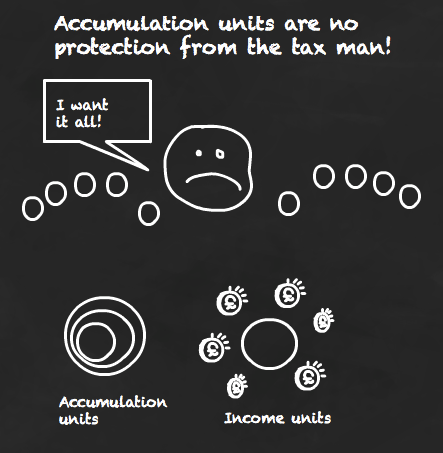

Accumulation Units The Income Tax Loophole That Never Was Monevator

Cares Act Implications On Corporate Earnings And Profits E P

Earnings And Profits Computation Case Study

How To Calculate Income Tax In Excel

What Are Accumulated Earnings Profits Accounting Clarified

Earnings And Profits Computation Case Study

Determining The Taxability Of S Corporation Distributions Part I

Demystifying Irc Section 965 Math The Cpa Journal

What Are Accumulated Earnings Definition Meaning Example

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Determining The Taxability Of S Corporation Distributions Part Ii

Demystifying Irc Section 965 Math The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

What Are Earnings After Tax Bdc Ca

Excel Formula Income Tax Bracket Calculation Exceljet

Determining The Taxability Of S Corporation Distributions Part Ii